tax loss harvesting rules

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. Help your clients reduce tax risk while maintaining market exposure.

Tax Loss Harvesting Napkin Finance

Learn How to Harvest Losses to Help Reduce Taxes.

. Capital Gains Tax-Loss Harvesting Rules Annual Limit to Harvesting Tax Losses. As with any tax-related topic there are rules and limitations. Do you have enough money.

Ad Download this must-read guide about retirement income from Fisher Investments. Once losses exceed gains. To claim a loss on your current.

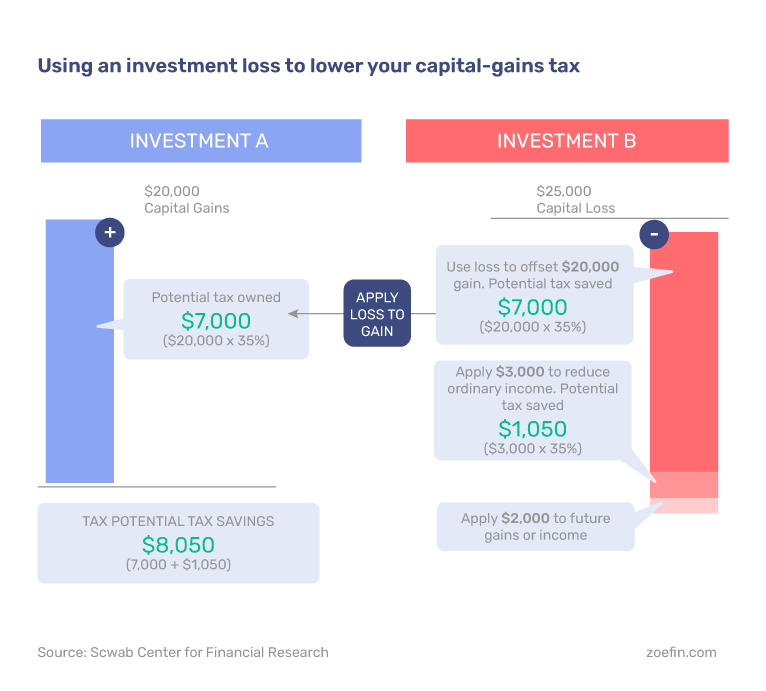

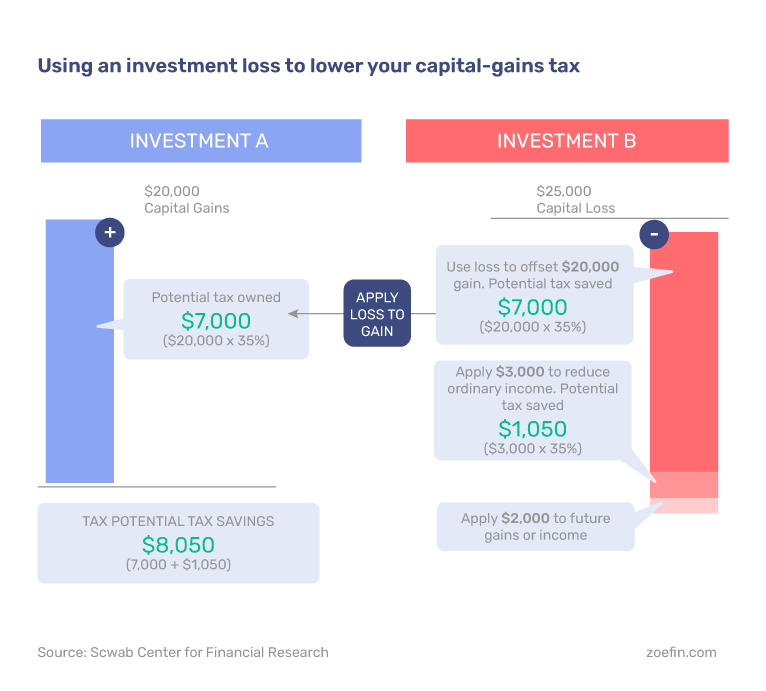

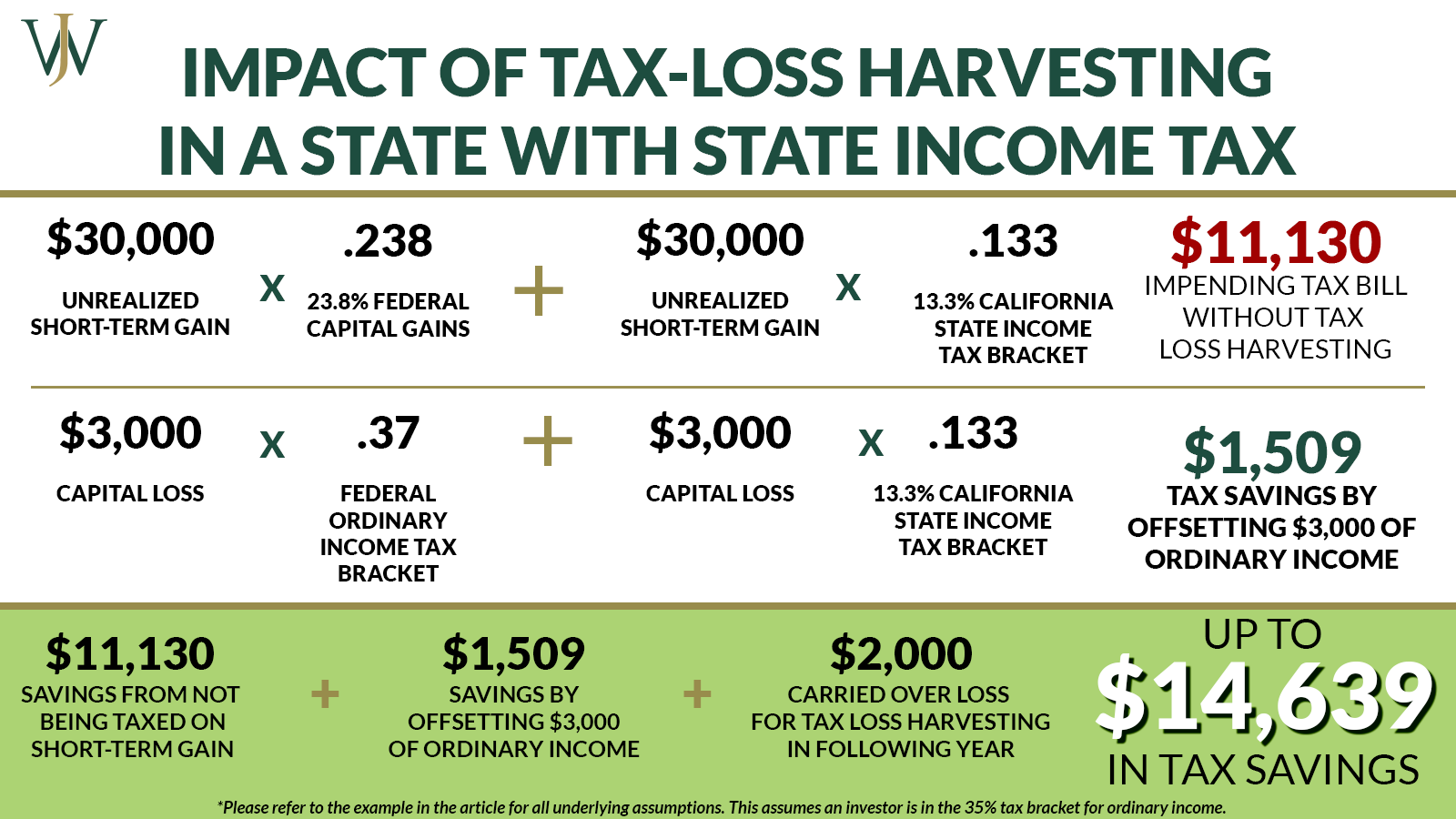

There are some rules to keep in mind. The idea behind tax-loss harvesting is to offset taxable investment gains. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income.

Tax loss harvesting is when you sell securities for less than their cost basis or the price you originally paid for them. Ad Over 25 years of offering tax-managed investing solutions to advisors and their clients. Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income.

When done without regard for the clients bigger picture tax-loss harvesting is as likely to have a negative outcome for the investor as a positive one. There are a few important tax-loss harvesting rules. In taxable accounts when you sell a position that has lost value you can use the loss to offset capital gains that result from selling securities at a profit.

You have to use short-term losses to offset short. 2 Harvest Losses in a. Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs.

Down Markets Offer Big Opportunities. Follow Tax-Loss Harvesting Rules. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the losses.

There are of course some rules governing tax-loss harvesting that youll want to know. Tax loss harvesting can be a great strategy to lower your tax bill. If youre not jumping around in the market market-timing.

Ad Visit models resource center to compare analyze cutomize and follow portfolios. Analyze and customize this portfolio or any other on our models resource center. How to Tax-Loss Harvest 1 Buy and Hold Investments You Want to Hold for a Long Time.

Last Day to Tax. How tax-loss harvesting works. But it comes with one big restriction.

This captures losses to offset gains you may have realized in. Learn How to Harvest Losses to Help Reduce Taxes. Tax-Loss Harvesting Rules 1.

You can only do tax-loss harvesting in your taxable brokerage accountsnot in 401ks or IRAs. Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits.

In general tax losses can offset any capital gains that you have. You have to wait 30 days to repurchase an investment you sold for a loss if. Issues To Consider Before Utilizing Tax.

To do it you simply need to lock in a. It applies only to investments held in taxable accounts. Youve worked your whole life to build wealth for retirement.

Your investments need to be in a taxable investment. Down Markets Offer Big Opportunities. Investors can offset up to 3000 per year and losses can be kept in.

As with any tax-related topic there are rules and limitations. What is Tax Loss Harvesting. Per the IRSs netting.

Do S And Don Ts Of Tax Loss Harvesting Zoe

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Top 5 Tax Loss Harvesting Tips Physician On Fire

Turning Losses Into Tax Advantages

How To Choose The Best State To Retire In

Year Round Tax Loss Harvesting Benefits Onebite

What Is Tax Loss Harvesting Ticker Tape

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting Definition Example How It Works

Top 5 Tax Loss Harvesting Tips Physician On Fire

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Turning Losses Into Tax Advantages

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh